when will capital gains tax increase take effect

Thus for households earning more than 1 million. While it technically takes effect at the start of 2022 it wont officially be collected until 2023.

Selling Stock How Capital Gains Are Taxed The Motley Fool

In 2021 the estate and gift tax exemption of 117 million 234 million for married couples will still allow your clients to pass on up to that amount before paying any estate tax but any assets rising above that threshold are at risk of double taxation estate tax and capital gains tax without the step-up exemption.

. The rates do not stop there. Originally posted on Accounting Today on July 7th 2021. The answer at least if President Biden has his way is that the increase would take effect as of April 28 2021.

Apr 23 2021 217 PM EDT. The recent change in presidency is set to bring about substantial changes in the way high-net worth individuals are taxed in relation to capital gains. One prominent proposal would be to tax capital gains as they accrue instead of waiting until an.

In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy. The top rate would be 288. When the NIIT is added in this rate jumps to 434.

If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28. The Biden administration has proposed a plan that will essentially double the capital gains tax for those investors making over 1 million as a method. Former Vice President Joe Bidens tax plan would take away the preferential 20 maximum capital gains rate.

Single filers with income over 523600. Ad Compare Your 2022 Tax Bracket vs. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Should Bidens new capital gains provisions take effect in 2022 your total tax would be increased by over 300000. Long-Term Capital Gains Taxes. Holding on to your home for at least a year would convert this to a long-term capital gain and reduce your capital gains tax bill to 52500 or 15 of your profit.

Biden is set to propose a sharp increase in capital gains tax to 396 from the current 20 level for those. Bloomberg calculated that the capital gains tax hike would affect about 032 of the. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of.

How to Avoid Capital Gains Tax on a Home Sale. FAQ on capital gains outlook and effective date. Additionally a section 1250 gain the portion of a.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Understanding Capital Gains and the Biden Tax Plan. Your 2021 Tax Bracket to See Whats Been Adjusted. For 2021 the top tax bracket includes the following taxpayers.

1 day agoUsing the short-term capital gains tax rates shown above the tax bill on your home sale would be 109736. Its estimated that the tax will bring in over 400 million in its first year. Were going to get rid of the loopholes that allow Americans who make more.

Joe Biden reportedly is going to propose raising the capital gains tax rate to 434 for wealthy. In this case it might be worth it to elect out of installment sale treatment. According to press reports the Presidents expected 6 trillion budget ties the increase to the date the White House first released its fact sheet on The American Families Plan which was on April 28 2021.

Youll owe either 0 15 or 20. President Bidens coming proposal to increase capital gains taxes for the richest Americans could push the rate paid by investors when they sell stocks and other assets as high as 567 in some. Discover Helpful Information and Resources on Taxes From AARP.

As mentioned earlier the IRS taxes short-term capital gains are taxed at the ordinary income tax rate. Both presidential candidates have suggested changes to the way capital gains get taxed. The capital gains tax rate increase to an effective rate of 434 the proposed 396 rate plus 38 net investment income tax would put a lot more pressure on recognition events said Steven M.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Additionally there has been a proposed increase to.

One approach to both reduce inequality and raise revenue is to reform the taxation of capital gains. But because the higher tax rate as proposed would only. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the.

This means that high-income investors could have a tax rate of up to 396 on short-term capital gains.

Capital Gains On Inherited Property

Reap The Benefits Of Tax Loss Harvesting To Lower Your Tax Bill Investing Income Tax Preparation Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Explained Propertyinvestment Flip Investing Knowthenumbers Capital Gains Tax Capital Gain Money Isn T Everything

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

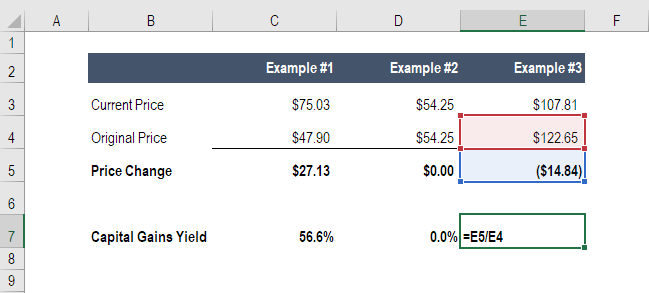

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Capital Gain Mutuals Funds Capital Gains Tax

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

Capital Gains Tax Capital Gain Integrity

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)